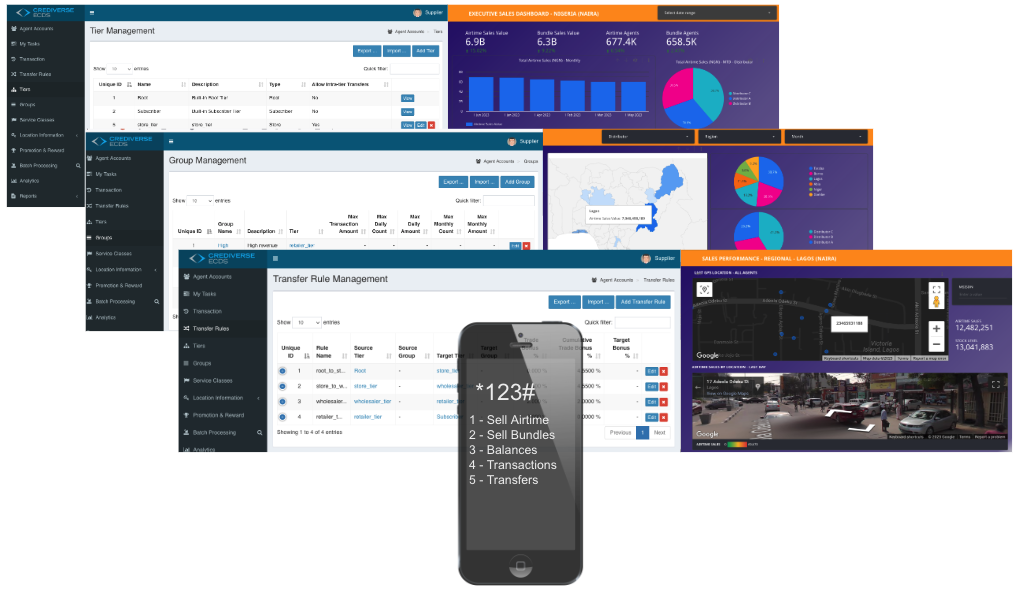

| User Interfaces |

- USSD (single shot and menu based communications), SMS, API, WebUI, Smartphone App

- Agent and agent account management, creation of business rules, system management, reporting functions and administrative actions are performed on the user interface by authorised administrative web-users

- Agents perform transfers, front office or call centre functions from the Agent Portal user interface, managing their own account and those of their sub-agents. Agents create and schedule reports to view the performace of their sub-agents.

- Authorised Agents connect to Crediverse using a REST API and may transact on behalf of the Agent in line with the assigned roles and permissions

|

| User Management |

- Different types of users are added to the System, each with distinct interests and roles.

- Web Users are authorised individuals who log into Crediverse and perform business processes associated with their role (Administrator or Supplier) within their assigned permissions.

- Agents are individuals authorised to perform various transactions among themselves or toward subscribers, governed by transfer rules. Some Agents may use the Agent Portal to perform transactions and manage their account.

- Sub-Agents are emissaries for the Owner Agent who have their own Crediverse account and operate under the Owner Agent

- Agent Proxies or Agent Users are individuals authorised to access Crediverse and operate on behalf of the owner agent from the owner account. They do not transact on their own behalf. "

- Large organisations assign specific functions, such as Call Centre, revenue assurance or data analysis functions, to a specific Department. The Department serves to group together web users that have similar functions.

- Each Web User, Agent or Agent User is assigned a role. Permissions to perform certain actions are granted to a role. Custom roles can be created and permissions assigned accordingly, affording fine grained management of who may access the System to perform various specified actions.

|

| Agent Management |

- Agents are onboarded to Crediverse to start their credit distribution journey. Agent accounts are created, and their position within the distribution hierarchy defined. The UI supports adding Agents, updating details and managing all aspects of the Agent in their role as distributor of airtime for the Operator.

- Different agent types are created to support effective credit distribution through the vast agent network. Owner Agents can transact on their own behalf, and manage their own network of Agents (sub-Agents), even assigning proxy agents to perform administrative functions and transactions on their behalf, from their Owner account. It is also possible for Agents to transact independently without being assigned an Owner Agent or managing their own set of sub-Agents or proxies.

- "Active: An Agent who is activated on the System, able to access the Agent Portal and transact using authorized channels.

Suspended: An Agent who is locked out of the System and unable to transact until the suspension is lifted i.e. he is restored to the Active state.

Deactivated: An Agent who no longer transacts on Crediverse, cannot access the System nor be restored to Active status. The MSISDN assigned to the agent can be allocated to another Agent.

Deleted: An Agent who was added in error and is to be removed and his record deleted. This is an Agent who has not transacted on the System and has no account balance.

Test*: A test Agent who was added to the System to perform user testing. The transactions performed using the test Agent do not display in system records nor affect the overall credit available in the System for distribution. "

- Agent account and business rule management can be performed via bulk operations. New Agents are added to Crediverse in bulk, as when migrating existing Agents to Crediverse from an incumbent system or when groups of Agents are onboarded by an Operator. The bulk operation allows setting all the relevant Agent properties (identification, role, hierarchy position, access channels) and loading these to the System from the UI. Once added, Agent accounts can be managed or edited using bulk operations. Similarly, business configurations such as transfer rules, tiers, agent groups and location information can be uploaded and updated using the batch processing module.

- When the Agent's account balance drops below this threshold, the Agent and the Owner Agent receive a warning SMS allowing proactive top-up of the available credit.

|

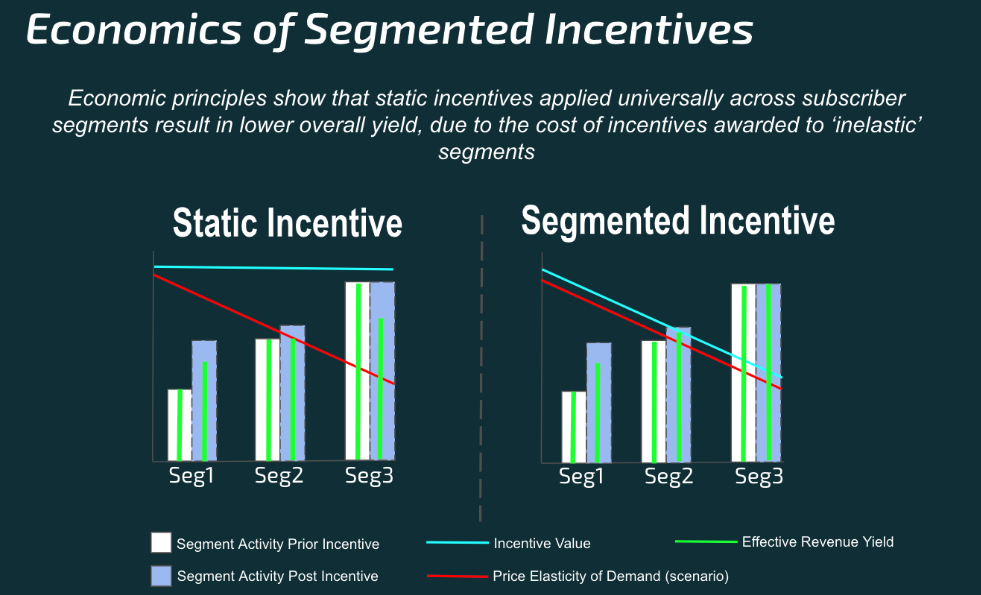

| Business Rules |

- Calculated automatically when the system is replenished and expresses the total bonus amount that would be awarded to Agents if all available credit passes through the distribution hierarchy from the Root account to the Subscriber. This provides insight into the bonus amount that should be provisioned and how changes to transfer rules and trade bonuses affect the provisional bonus amount.

- The standard cumulative trade bonus provides a view of the total bonus provision for sale of all credit through the system, following a deterministic route from the Root account to the Subscriber. The advanced cumulative trade bonus supports multiple transfer routes with variable trade bonuses awarded based on defined criteria. The cumulative trade bonus is calculated when the Root account is replenished and a band spanning the lowest and highest bonus payable reflected to aid the Operator in the planning of marketing campaigns. The actual cumulative trade bonus amounts awarded are calculated in real time and reflected on the system.

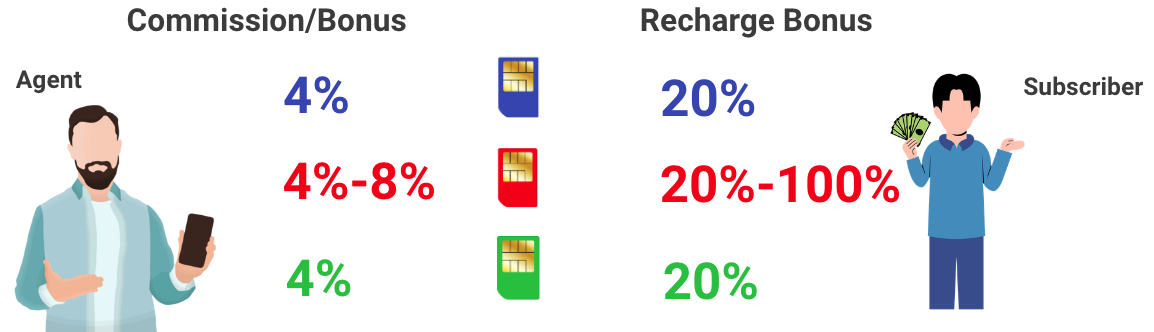

- "Transfer rules govern the sale or transfer of credit from an Agent belonging to a specified Tier, to a recipient Agent or Subscriber. Agents on the same Tier can perform intra-tier transfers, which by default do not attract bonus or commission payments. For transfers from a higher to lower tier, transfer rules allow setting transfer criteria and defining the bonus received by the recipient Agent when buying credit.

Specific transfer criteria may involve specifying the agent group, service class or location of the seller of airtime that may trade with a recipient or buyer of airtime, in a specified agent group, service class or location. Minimum and maximum limits may be set on the amounts that can be sold. Criteria defining the time of day, or day of week are configurable within the transfer rules.

The trade bonus earned by the recipient agent (buyer) when purchasing airtime is defined in the transfer rule.

The standard hierarchy structure supports one transfer rule set between a certain source tier and a specified recipient tier. "

- Highly flexible transfer rules supporting multiple transfer rules between the same Source and Recipient Tier, using different transfer criteria and attracting different trade bonuses. This powerful tool incentivises Agents to influence subscriber behaviour and purchasing patterns to increase their own gains.

- A distribution hierarchy is represented by Agent tiers. The uppermost mandatory tier is the root account tier, representing the credit or stock available for distribution. The lowest tier is the mandatory subscriber tier, representing the purchasers of airtime and mobile services. In between these tiers, a flexible hierarchy of tier types can be created such as Root -> Store -> Wholesaler -> Retailer -> Subscriber. It is possible to create levels within each tier type such as multiple wholesaler tiers, with transfer rules guiding how credit may flow between them and onward to the retailer tier. Tiers are created and assigned custom names, with various rules configurable per tier such as the maximum transaction amount allowed, maximum number of transactions and value per day or per month. Intra-tier transfers can be restricted or allowed depending on business requirements.

- Groups are a collection of Agents from the same tier, who share certain characteristics and to whom the same business or transfer rules apply. This allows agent segmentation and applying finer-grained transfer rules to agents. As for tiers, daily and monthly maximum transaction values and counts can be set.

- Classes can be created in Crediverse and assigned to agents. Unlike Groups, the service class can be applied to agents across different tiers, allowing more segmentation options for incentivising and managing agents. In this way, new agents, or those who are lagging in sales can be identified through a service class and be targeted differently with an applicable transfer rule.

- Crediverse optionally enforces location based rules governing transfer of credit between agents. Cells (GSM Cell Ids) are loaded to Crediverse and assigned to one or more areas of differing area types (e.g suburb, town, city, metropolitan, province). A geographical hierarchy is created and Agents can be restricted to trading within their area only.

- In addition to defining how agents may trade geographically, transfer rules support awarding different trade bonuses to agents in different regions.

- As for agent account management, the creation, updating and assigning of business rules is possible via bulk operations as well as from the UI.

- "If a particular transfer rule, tier, group etc has been used in a transaction, it can be deleted only once the applicable transaction records have been archived as defined by the data retention configurations.

The System checks transfer rules added and identifies possible conflicting rules which may create ambiguity when processing the trade bonus to be awarded."

- Promotions allow the Operator to further incentivise Agents by rewarding them with additional credit if they achieve a sales target for a specific set of circumstances and period of time. A transfer rule is assigned and criteria such as sales target amount and target period defined. Upon achieving the sales target the Agent is awarded to the Crediverse account and receives a congratulatory promotion message.

|

| Agent incentive |

- Proven 400+ transactions per second (TPS) per node on recommended hardware

|

| Bundle Management (optional) |

- Creates bundles to be sold by agents and sets up commissions to incentivise agents to sell certain bundles to subscribers

- Allows agents to promote new and exciting bundles directly to subscribers

- Subscribers can purchase the bundles they want directly from agents, without having to navigate complex USSD menus

- Bundles consisting of data, SMS, voice minutes or a combination thereof can be sold

|

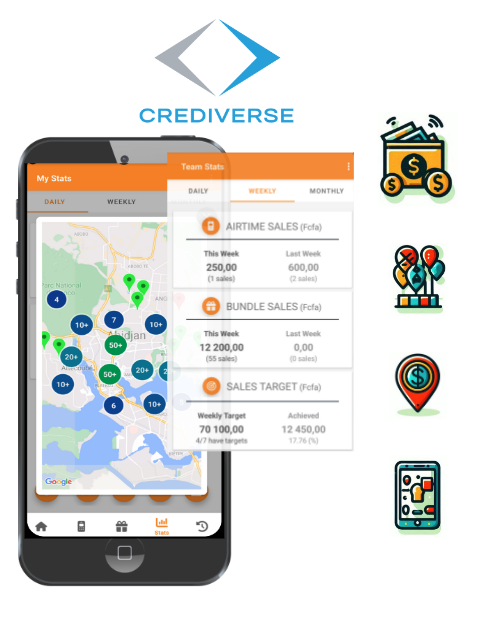

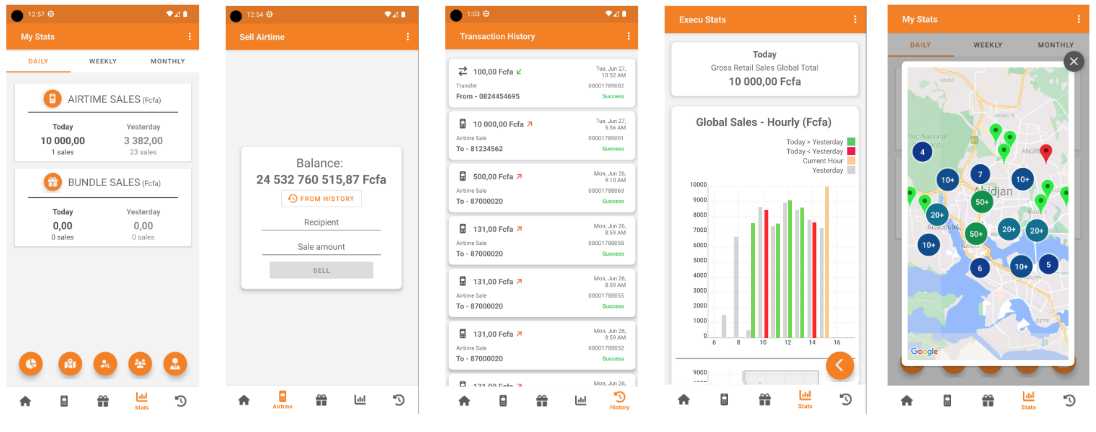

| Smartphone Application and Web Portal |

- Rich smartphone application that agents use to transact with subscribers as well as each other, monitor their airtime sales in near real-time, and keep track of bonus commissions (Note: Agents using feature phones transact via USSD or SMS)

- Web portal has the same functionality as the smartphone app, but in addition is able to reset the agent’s PIN, verify transfers, perform reversal transactions, and view performance reports for all agents under the same umbrella

|